Bam: Microfinance NGOs Act to help eradicate “5-6”

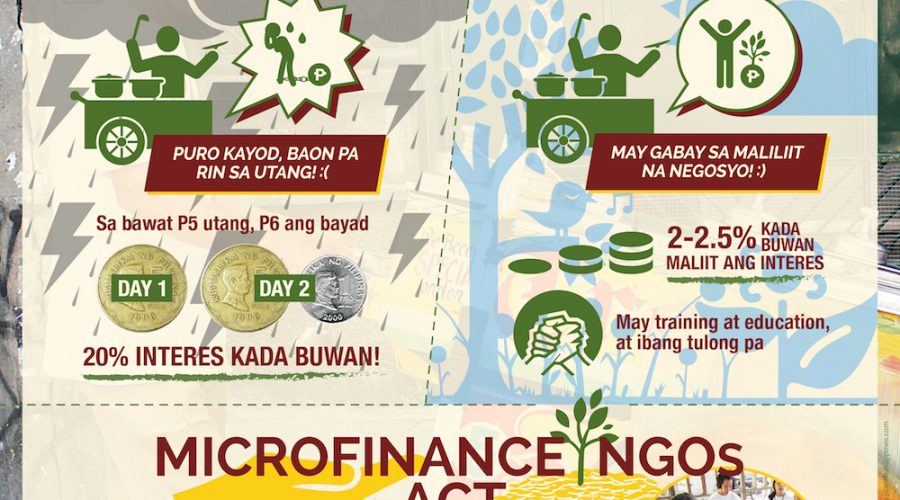

The Microfinance NGOs Act will help the government’s plan to eliminate loan sharks or “5-6” as it will provide the poor with alternative low-interest, no-collateral financing, according to Sen. Bam Aquino.

“Sa Microfinance NGOs Act, may alternatibong malalapitan ang mahihirap at maliliit na negosyante para makakuha ng pautang sa mababang interes,” said Sen. Bam.

“Sa batas na ito, mailalayo ang mahihirap sa malaking interest na sinisingil ng loan sharks at masusuportahan ang pagnanais ng gobyerno na mabura ang 5-6,” the senator added.

During the 30th anniversary of 30th Anniversary of Center for Agriculture and Rural Development Mutually Reinforcing Institutions or CARD-MFI, one of the biggest MFI-NGO in the Philippines, Sen. Bam hailed the MFIs’ role in helping Filipino women entrepreneurs.

“When you look at the stories na lumalabas, apat na milyong kababaihan ang natutulungan na magnegosyo at makakuha ng tulong para sa kanilang, mas malaking income para sa kanilang mga anak,” said Sen. Bam.

“Maganda mapag-usapan ang kuwentong ito na nagdadala ng pag-asa sa kabila ng kuwentong patayan at tungkol sa drugs,” added Sen. Bam, who worked closely with MFIs as a social entrepreneur prior to being a senator.

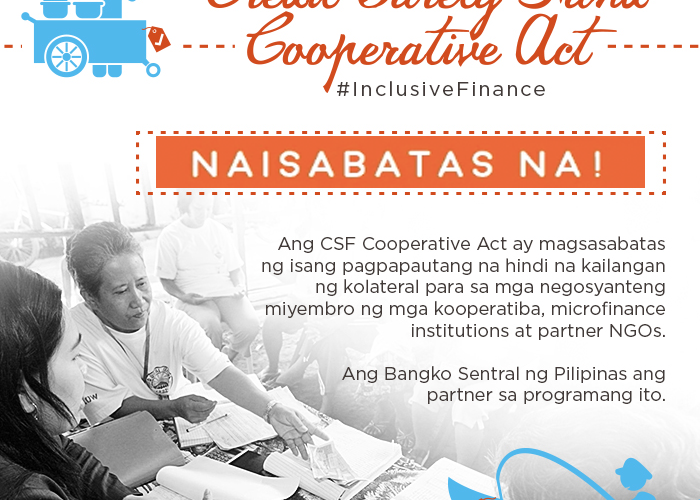

Sen. Bam pushed for the passage of the Microfinance NGOs Act or Republic Act 10693 as co-author and principal sponsor in the Senate during his term as chairman of Committee on Trade, Commerce and Entrepreneurship in the 16th Congress.

In turn, MFI NGOs give Filipinos access to low-interest, no collateral loans to pay for housing, medical, and educational needs as well as loans for small businesses.

The law gives incentives to microfinance NGOs to continue helping Filipinos overcome poverty not just through financing but also through financial literacy, livelihood, and entrepreneurship training.

The law also provides microfinance NGOs needed support and incentives that includes access to government programs and projects, technical assistance and exemption from taxes.

“MFI NGOs aid our poor countrymen in times of inflation and price increases. They also provide financing and training for livelihood and small businesses so families can overcome poverty,” he said.

“Now that the MFI NGOs Act has been passed and the IRR signed, let’s push for its quick and effective implementation,” he added.

In 2013, MFI NGO members of the Microfinance Council of the Philippines, Inc. (MCPI) had a gross loan portfolio of over 15.26 billion pesos catering to more than 2.7 million micro-entrepreneurs.

Recent Comments