Bam fulfills campaign promise to alleviate poverty through Entrepreneurship, Employment and Education

In 2013, Sen. Bam Aquino ran with a campaign promise of uplifting lives of Filipino families and fighting poverty through education, employment, and entrepreneurship or the 3Es.

In his first three years, Sen. Bam Aquino laid the foundation for the growth of micro and small businesses, improved access to financing for entrepreneurs, lowered logistics costs for imported and exported goods, and ensured the financial literacy of generations to come.

During the 16th Congress, he worked for the passage of 14 laws in line with his commitment to the Filipino people. Nine of these laws were aligned with his advocacy to build an effective support network for local business, particularly the micro, small and medium enterprises (MSMEs), and promote ease of doing business.

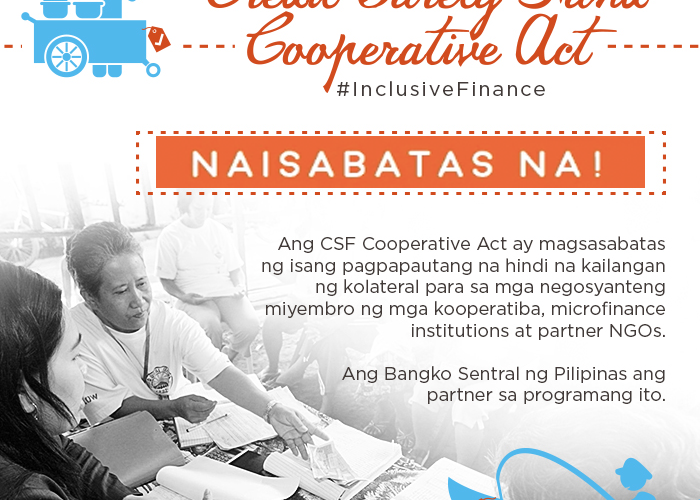

These are the landmark Philippine Competition Act, Go Negosyo Act, Foreign Ships Co-Loading Act or Amendments to the Cabotage Policy, Youth Entrepreneurship Act, Microfinance NGOs Act, Credit Surety Act, Lemon Law, the Customs Modernization and Tarrif Act, and the Department of Information and Communication Technology (DICT) Act.

After gathering dust for more than two decades, the Philippine Competition Act was finally enacted into law thanks to Sen. Bam Aquino’s efforts as co-author and principal sponsor in the Senate.

Dubbed by Sen. Bam as a “historic, game-changing legislation for the economy”, the Philippine Competition Act or Republic Act 10667 provides a level-playing field for all businesses and penalizes bad market behavior and abuse of dominant positions.

The law expected to improve the quality and lower the prices of goods and services by eliminating cartels, and penalizing anti-competitive agreements and abuses of dominant players in the market.

The Go Negosyo Act, the first law passed by Sen. Bam in the 16th Congress, mandates the establishment of Negosyo Centers in all municipalities, cities and provinces that will assist micro, small and medium enterprises in the country.

“This is a part of our pledge to work for the development of MSMEs to help create jobs and livelihood for many Filipinos and spur the country’s economy,” said Sen. Bam, the youngest senator in the 16th Congress.

There are already 200 Negosyo Centers catering to the needs of struggling entrepreneurs in the country, from returning OFWs and carinderia owners to farmers and social entrepreneurs.

As chairman of the Committee on Trade, Commerce and Entrepreneurship, he also initiated investigations into the slow and expensive Internet in the country and the congestion in the Port of Manila.

The investigation produced several triumphs that will help improve the Internet service in the country, including the much-awaited IP Peering between Globe and PLDT.

In the 17th Congress, he is expected to head the Committee on Education, hoping to elevate the quality of Philippine education, particularly in our public schools to global standards so that more young Filipinos can build a brighter future for themselves and their family.

Sen. Bam has already filed four education-related measures such as the Free Education in State Colleges and Universities (SUCs), Free Education for Children of Public School Teachers’ Children, Abot Alam, and the Trabaho Center in Schools bills.

Even with education on his mind, he continues to push for his social entrepreneurship advocacy and is still building a robust support system for small business with the filing of bills to support Small Business Tax Reform, Startups, and Social Enterprises, among others.

Sen. Bam is relentless in his pursuit to fulfill his campaign promise of the 3Es to achieve inclusive growth and help Filipino families overcome poverty.

Recent Comments