Sen. Bam renews call to suspend excise tax on fuel after big-time oil price hike

Sen. Bam Aquino reiterated his call to suspend the excise tax on petroleum products under the Tax Reform for Acceleration and Inclusion (TRAIN) Law following the recent big-time fuel price hike due to increase in oil prices in the world market.

“Hindi pa nga nakakahinga ang taumbayan sa mataas na presyo ng pagkain at iba pang bilihin, unti-unti na namang umaakyat ang presyo ng langis sa world market,” said Sen. Bam, one of four senators who voted against the ratification of the TRAIN Law.

“Kaya mas magandang itigil na ng pamahalaan ang excise tax sa langis sa ilalim ng TRAIN Law bago pa ito magdulot ng dagdag pang pasanin sa taumbayan, lalo na sa mahihirap,” added Sen. Bam.

Sen. Bam has filed Bawas Presyo sa Petrolyo Bill in May 2018 to suspend and roll back the excise tax on fuel once the country’s inflation rate exceeds the government’s target for three straight months.

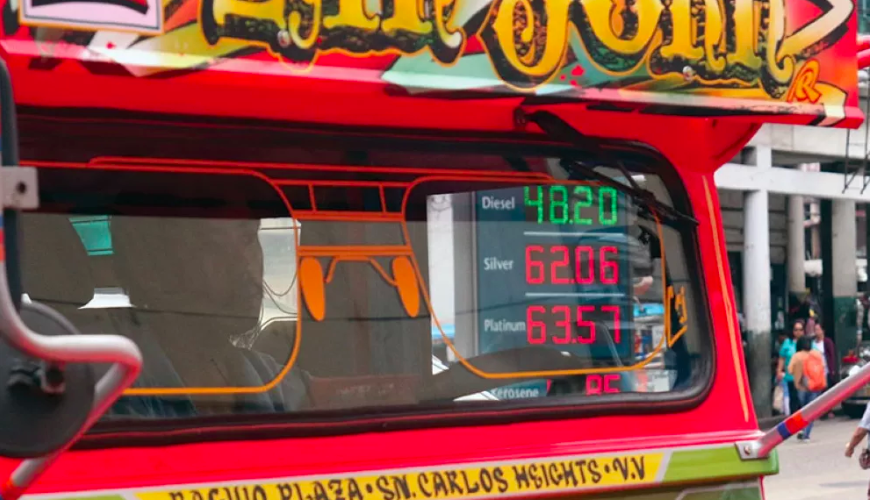

On Tuesday, oil companies have announced increase of a least P1.40 per liter for gasoline, P2.30 per liter for diesel and P2.00 per liter for kerosene due to increase in world crude prices.

The second part of the excise tax hike under the TRAIN Law is not yet included in the increase.

Earlier, Sen. Bam slammed the government decision to implement the second part of excise tax under the TRAIN Law, emphasizing that the country’s inflation rate remains far from the government’s inflation rate target of 2-4 percent.

“Nalulunod pa rin sa mahal na presyo ng pagkain at bilihin ang ating mga kababayan kaya napakalaking pagkakamali na payagan ang ikalawang bahagi ng excise tax sa ilalim ng TRAIN Law,” said Sen. Bam.

Recent Comments