Bam Lauds BIR Extension for ‘No Payment’ Returns

“Salamat sa pakikinig sa ating mga Boss.”

Senator Bam Aquino lauds the Bureau of Internal Revenue (BIR) for granting a two-month reprieve to taxpayers with “No Payment” returns, a move that will benefit many small and medium enterprises and self-employed individuals.

“The extended deadline will be a big help to many of our SMEs and self-employed who are included in this category,” said Sen. Bam, chairman of the Senate Committee on Trade, Commerce and Entrepreneurship.

Sen. Bam’s pronouncement came after BIR Commissioner Kim Jacinto-Henares announced that taxpayers with No Payment returns will be allowed to file manually but will be required to re-file electronically on or before June 15, 2015.

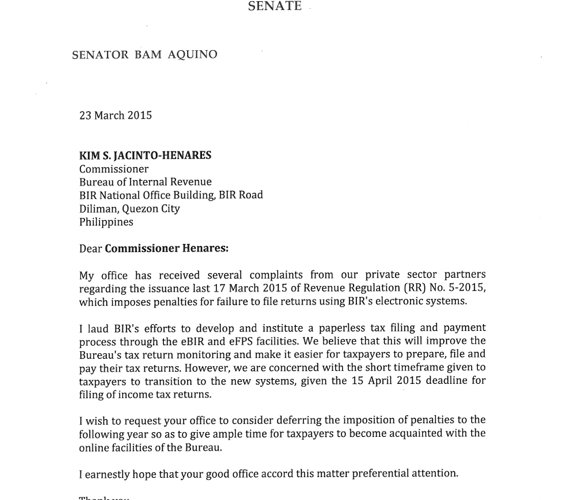

Earlier, Sen. Bam asked the BIR cancel the imposition of penalties on taxpayers covered by the Electronic Filing and Payment System (eFPS) or Electronic BIR Forms (eBIRForms) who failed to file tax returns under the electronic systems.

In his letter, Sen. Bam called on Henares to suspend imposition of penalties under Revenue Regulation No. 5-2015 until next year to give taxpayers enough time to familiarize themselves with the agency’s online facilities.

At the same time, Sen. Bam urges the BIR to clarify those covered by the e-filing for the guidance of the agency’s regional district offices (RDOs).

“It will be helpful if the BIR could cite some clear examples so taxpayers could assert that they are not required to e-file once they go to their respective RDOs,” Sen. Bam said.

“Based on numerous complaints from the taxpayers, the issuance of the revenue regulations and the memorandum circular has caused confusion regarding the proper implementation of the revenue regulations and the memorandum circular,” said Sen. Bam.

“Tulungan natin ang ating maliliit na negosyante at hindi tayo maging pahirap sa kanilang mga negosyo,” added Sen. Bam.

Recent Comments