Bam: Postpone Penalties under BIR’s eFPS, eBIR Systems

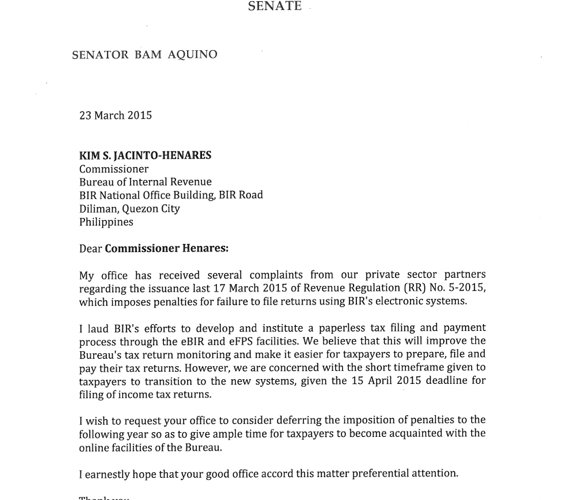

Senator Bam Aquino calls on the Bureau of Internal Revenue (BIR) to defer the imposition of penalties on taxpayers covered by the Electronic Filing and Payment System (eFPS) or Electronic BIR Forms (eBIRForms) who failed to file tax returns under the electronic systems.

In his letter, Sen. Bam requested BIR Commissioner Kim Jacinto-Henares to suspend imposition of penalties under Revenue Regulation No. 5-2015 until next year to give taxpayers ample time to become acquainted with the agency’s online facilities.

The BIR issued the regulation on March 15, 2015 and it was published in a national daily two days later.

“We are concerned with the short timeframe of less than a month given to taxpayers to transition to the new systems, given that the deadline for filing of income tax returns is on 15 April 2015 already,” Sen. Bam said in his letter.

Sen. Bam made the move after receiving several complaints from private sector partners regarding RR No. 5-2015.

Under RR No. 5-2015, all taxpayers mandatorily covered to file their returns using eFPS or eBIRForms, who fail to do so, shall be imposed a penalty of P1,000 per return pursuant to Section 250 of the National Internal Revenue Code (NIRC) of 1997, as amended.

In addition, the taxpayer shall also be imposed civil penalties equivalent to 25 percent of tax due to be paid, for filing a return in a manner not in compliance with existing regulations.

Moreover, Revenue District Offices are directed to include the non-compliant taxpayers in their priority audit program.

At the same time, Sen. Bam lauded the BIR for its effort to develop and institute a paperless tax filing and payment process through the eBIR and eFPS facilities.

“We believe that this will improve the Bureau’s tax return monitoring and make it easier for taxpayers to prepare, file and pay their tax returns,” Sen. Bam said.

Recent Comments