Sen. Bam Aquino’s Privilege Speech On rising prices and the suspension of TRAIN

Mr. President, mga kaibigan, karangalan ko po ngayon na pagusapan ang isang bagay na nakakabagabag sa maraming pamilyang Pilipino – ang patuloy na pagtaas ng presyo ng bilihin.

Nalulunod na po ang mga mahihirap nating kababayan sa patuloy na pagtaas ng presyo ng bilihin.

Noong kami ay bumisita sa mahihirap na komunidad at kinausap ang ating mga kababayan tungkol sa kanilang mga hinaing, ang una po nilang lagging binabanggit ay ang presyo.

Ito ang ilan sa sinasabi nila:

Grabe na nga ang hirap at gutom dati, mas grabe pa ngayon. Saan na po kami pupulutin?

Mababa ang kita. Mataas ang presyo. Matindi ang aming pangamba.

Dalawang beses na lang po kami kumakain araw-araw.

Iyong mga may kaya, kakayanin ang pagtaas ng presyo. Pero kaming mahihirap, hindi po naming ito kaya.

Nahihirapan na po ang ating mga kababayan, lalo na ang mga nasa laylayan.

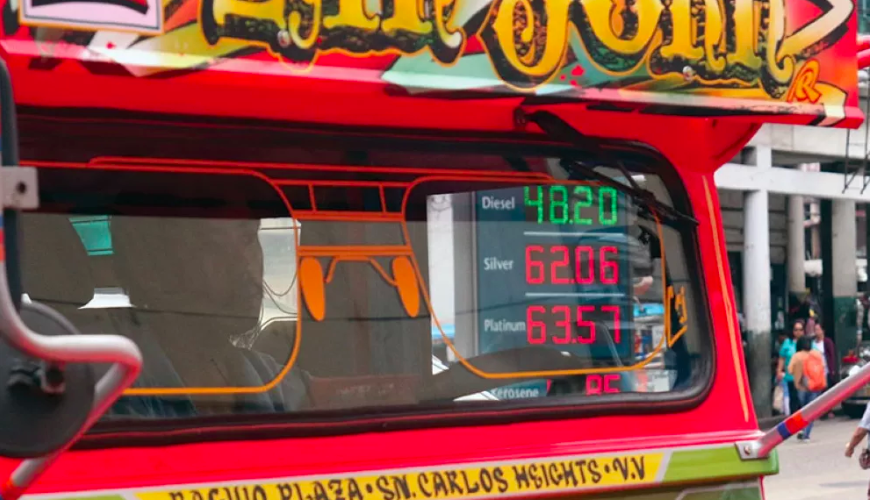

Kahapon lang po, tumaas na naman ang presyo ng petrolyo.

In the past months, makikita ho natin ang pagtaas ng presyo ng gasoline, diesel at kerosene.

Sa Robinson’s Supermarket, ang Ligo Sardines na 14 pesos noong Disyembre, 16 pesos at 25 centavos na ngayon.

Ang mga nanay na nakausap ko sa Bagong Silang, hindi na po nakapagta-Tang!… kundi napapamura na lang sa presyo ng Tang. Dati ay 9.10 pesos per sachet, pero ngayong Mayo ay malapit na po sa 17 pesos sa grocery.

Tumataas din ang presyo ng kuryente, ang presyo ng bigas, at humihingi na ng fare hike ang mga jeepney drivers at operators, pati na ang LRT.

Kaya naman po napakarami na ang umaalma.

Currently, inflation is on the rise and has surpassed the expected levels for 2018. Ngayon po ay 4.5% na tayo at ang yearly forecast ng BSP ginawa na pong 4.6% para sa buong taon.

Mr. President, marami ang nagsasabi na hindi lang naman TRAIN ang rason sa pagtaas na presyo, at tama po iyon.

Ngunit alin po ba sa mga rason ng pagtaas ng presyo ang kaya natin bigyan ng solusyon at alin po diyan ang hindi natin masosolusyunan?

Sa hearing ni Sen. Gatchalian dito sa Senado noong nakaraang mga linggo, binigay ng Department of Finance (DOF) ang breakdown of factors of inflation.

Sabi po nila, better tobacco compliance, global prices of crude oil, the devaluation of the peso, meron pong unwarranted increase of prices, and, syempre po binanggit din nila ang TRAIN Law.

Alin sa mga ito ang wala na sa ating kamay, at alin po dito ang mahahanapan natin ng solusyon?

Habang patuloy ang debate sa mga rason ng pagtaas ng presyo, ang hinahanap ng taumbayan solusyon, hindi po dahilan. Hindi po debate, solusyon po para sa ating mga problema.

Kaya mga kaibigan, kailangan natin itong aksyunan.

Una, siguraduhin nating ipinapatupad ang unconditional cash transfer program na nakasaad sa TRAIN Law.

Because of TRAIN’s effect on prices, the law mandated that 10 million Filipino households would receive financial assistance worth 200 pesos per month.

Tumaas na po ang presyo ng bilihin ngunit 2.6 million families pa lang ang nakakatanggap ng financial assistance. 2.6 million out of 10 million pa lang ang nabibigyan ng tulong at ngayon po ay Mayo na.

Noon pa man, hindi po mapangako ng DSWD na masasabay ang tulong pinansyal sa pagpataw ng excise taxes at ito ang naging pangunahing rason kung bakit ako tumutol ng TRAIN Law.

Now, with the rapid increase in prices, Sen. Gatchalian suggested to increase the amount of cash transfers – and I definitely agree and I think many of us will do so as well.

This is something we must seriously look at during our budget deliberations.

Ano po ang isang bagay na puwede nating maaksiyunan. The second thing government can do to help Filipino families is to address the high price of rice.

Dahil po sa kapalpakan ng NFA na mapanatili ang 15-day buffer stock, mula 27 pesos per kilo ng bigas noon, ngayon ay higit 42 pesos na.

Noong bumisita ako sa Barangay Holy Spirit sa Quezon City, may nagsabi na isang beses na lang sila nagkakain bawat araw, at kamote na lang ang sinasabay nila sa ulam tuwing gabi.

Thanks to Sen. Villar, we tackled this in the Senate, thanks to Sen. Villar. And we are hopeful that action points coming from the Committee on Agriculture to get the price of rice under control will be prioritized.

Ito pong rice tariffication na shunestiyon ng Committee on Agriculture, kailangan na pong mabigyan ng pansin because this is a reform that our countrymen desperately need.

Pangatlo, ano po ang isa pang puwede nating solusyon sa pagtaas ng presyo ng bilihin? Kailangan natin ng mekanismo kung saan puwede nating i-roll-back ang pagtaas ng presyo ng petrolyo dahil sa excise taxes na pinapataw ng TRAIN Law.

The current version has a safeguard to suspend any additional imposition of excise tax, if the price of crude oil breaches 80 dollars per barrel.

Ang mekanismo pong ito ay mahahanap natin sa TRAIN Law ngayon. Ngunit mga kaibigan, ang crude oil ay may iba’t ibang klaseng depinisyon. Nandiyan ang BRENT crude oil na lumampas na po sa 80 dollars per barrel kahapon at nagsara po sa 79.11 dollars. BRENT is usually higher than the Dubai crude oil price based on Mean of Platts Singapore (MOPS), which is what the TRAIN Law based their provisions on.

In short, mga kaibigan, doon sa tatlong depinisyon ng crude oil, iyong BRENT, iyong WTI at MOPS, iyong isa po lumampas na kagabi ng 80 dollars per barrel, iyong dalawa hindi pa lumalampas.

Ngunit kung matutupad po ang suspension ng TRAIN based on the current provision currently found in the law, ang suspension po na mangyayari ay magkakaepekto lang sa Enero ng 2019.

In short, with the current wording of the law, any suspension based on the current law will only affect the January 2019 and possibly the January 2020 price increase.

What we need is a safeguard, Mr. President, which is responsive to the surges in prices and the needs of our countrymen.

In the Senate, in our Senate version, we actually passed a safeguard to suspend excise tax on fuel based on inflation. Ito po iyong probisyon na pinagbotohan nating lahat. However, this provision was removed during TRAIN’s bicameral conference.

In short, Mr. President, iyong lumabas sa Senado na version ng TRAIN, kasama po ang inflation rate bilang isa sa batayan kung bakit po dapat isuspinde ang excise taxes na napapasaloob sa TRAIN Law.

Unfortunately, nawala po ito pagkatapos ng bicameral conference at natira na lang ang probisyon na tumutukoy sa Dubai crude oil price.

Our office filed SBN 1798 to bring back this safeguard mechanism based on the inflation target range, so we can roll back TRAIN’s excise tax on fuel.

Under this bill, when inflation exceeds the target range for 3 consecutive months, the excise tax on fuel will be rolled back.

For example, kung titingnan natin iyong taon ngayon, the BSP set the target inflation range 2-4%.

In December, the month that we passed TRAIN, inflation was at 2.9. In January, after the TRAIN law was implemented, inflation shot up to 3.4 percent. On February, 3.8 percent, kasama pa rin po iyan sa target range ng Bangko Sentral ng Pilipinas,

In March, we breached the 4-percent range, it grew to 4.3 percent. In April nagging 4.5 percent. Pangalawang buwan na po ito na lumampas sa inflation target range ang inflation ng ating bansa.

Pagkatapos na mangyari ito, ang BSP nag-recompute at nagsabi na ang bagong forecast nila para sa taong 2018 ay 4.6 percent. At alam naman natin na ang inflation ay ang tumutukoy sa pagtaas ng presyo ng bilihin sa ating bansa.

Dahil napagbotohan na natin ang isang probisyon kung saan ginagamit ang inflation rate range bilang isang safeguard mechanism ditto sa pagpataw ng escise taxes sa ating bansa, umaasa ako na mabilis nating maipapasa sa ating Kamara.

This is a very reasonable amendment that can help alleviate the burden of high prices on our fellow countrymen.

Mr. President, mayroong pong mga nagsasabi na kung suspindihin ang excise taxes, wala nang pera para sa Build-Build-Build, wala na raw pera para sa libreng tuition sa ating mga SUCs. Wala na raw pera para sa mga programa ng gobyerno.

Sa totoo lang po, hindi ito totoo. Dahil kung tutuusin po, ang 2018 target collections ng excise tax on fuel base sa TRAIN ay 70 billion pesos lang po. Malayo naman ito sa kabuuan ng ating budget for 2019.

Sigurado po ako na mayroon tayong mahahanap na 70 billion pesos para pagtakpan kung may pagro- roll back na gagawin sa excise tax on fuel.

Una, mayroong underspending ang gobyerno mula sa 2017 na 390 billion pesos.

Pangalawa, kailangan lang na mas maging efficient ang collections ng BIR at BOC, at kakayanin natin iyan.

Pangatlo, I’m certain that under the leadership of Sen. Legarda in the Committee on Finance, and of course with the help of the sharpest eyes in the Senate, Sen. Ping Lacson, na kapag panahon po ng budget, may mahahanap na pera pong masi-save at pera pong magagamit sa ibang bagay, I’m sure may mahahanap tayong 70 billion pesos mula sa iba’t ibang departamento at iba’t ibang ahensiya na puwedeng makalap upang pagtakpan kung may mawawalang koleksiyon kung isuspinde natin ang excise tax on fuel.

Huwag na huwag po nating natin kakalimutan kung sino ang ating ipinaglalaban ditto sa Senado — ang pamilyang Pilipino na ngayon ay nahihirapan dahil sa patuloy na pagtaas ng presyo.

Kailangan ho nating umaksyon, hindi lang po magdebate.

Number one, siguraduhin natin na ang tulong pinansyal sa ating mga mahihirap na mga kababayan na nakasaad sa TRAIN Law ay mapatupad na. Kailangan po lahat ng ten million families na dapat mabigyan ng tulong, mabigyan ng tulong sa lalong madaling panahon. Hindi po katanggap-tanggap na sa September pa sila mabibigyan ng tulong o next year pa.

Pangalawa, suportahan natin ang mga gawain ng Committee on Agriculture pagdating sa reporma sa NFA at sa reporma patungkol sa ating bigas at kung paano ito mapapababa. Sana po maging priority measure natin ito dito sa ating Kamara.

Pangatlo, suportahan po sana natin itong naihain namin SBN 1798. Again, a very reasonable mechanism which we can use to roll back the price of excise tax on fuel only when the inflation target range is breached.

Isa po itong probisyon na sinang-ayunan na ng Kamara noong naipasa sa 3rd reading ang TRAIN dito sa Senado. Sinisikap lang namin ibalik ang safeguard na ito at gawing ganap sa ating bansa.

This is a reasonable mechanism that can alleviate the burden of our countrymen which can be responsive to the rise in prices.

Protektahan po natin ang pamilyang Pilipino mula sa pagtaas ng presyo.

Dahil sabi nga po, grabe na ang hirap at gutom dati, mas grabe pa ngayon.

Sabi nga po, matindi ang pangamba ng pamilyang Pilipino.

Sabi nga po, ang ating mga kababayan, ang ilan sa kanila ay hindi na nakakain ng tatlong beses isang araw.

Sabi nga po, hirap na hirap na ang taumbayan at tungkulin natin ang mapagaan ang kanilang buhay

Maraming maraming salamat po! And we hope we can all come together to support SBN 1798 very soon. Maraming salamat, Mr. President.

Recent Comments