Bam to BIR: Postpone Deadline, Cancel Penalties

“Huwag na nating pahirapan ang ating mga Boss.”

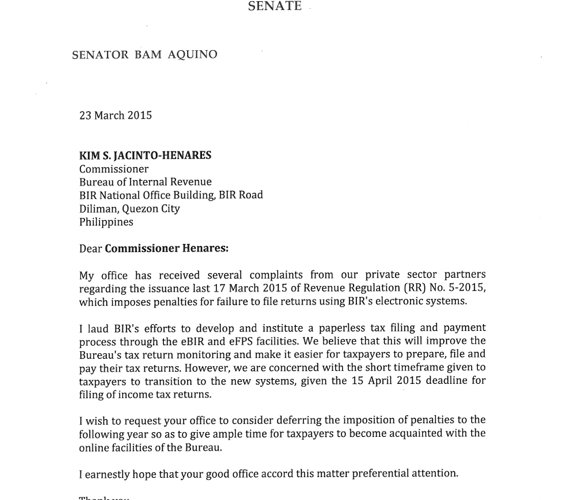

Senator Bam Aquino emphasized this plea as he reiterated his call to Bureau of Internal Revenue (BIR) Commissioner Kim Jacinto-Henares to suspend the imposition of penalties to taxpayers for failure to use its new electronic filing system.

“We should make things easier for our taxpayers, not make things difficult for them,” Sen. Bam stressed.

Earlier, Sen. Bam called on the BIR to cancel the imposition of penalties on taxpayers covered by the Electronic Filing and Payment System (eFPS) or Electronic BIR Forms (eBIRForms) who failed to file tax returns under the electronic systems.

The BIR issued the regulation on March 15, 2015 and it was published in a national daily two days later, giving taxpayers less than one month to comply with the new policy.

“The fines are not commensurateto the ‘offense’ of manual filing. Saan ka nakakita, gusto na ngang magbayad, bibigyan mo pa ng multa,” he added.

Aside from this, Sen. Bam said the BIR personnel’s inability to explain the new procedures further adds to the taxpayers’ woes.

“The BIR local offices have conflicting statements on how to proceed, who are covered, determination of penalties, etc. This creates uncertainty in our taxpayers which in turn lead to dissatisfaction. Kahit yata sila nalilito how to implement this new policy,” Sen. Bam said.

Sen. Bam suggested that the BIR stick to the policy but extend the deadline for filing for another three months.

“The BIR also needs to ensure that their online system can handle the volume of downloads that will only increase in the next few days,” he said.

Sen. Bam also encouraged the BIR to establish online kiosks/stations at local BIR offices with personnel who will help input the returns of our taxpayers and teach them with new procedures.

“In this way,” Sen. Bam said, “BIR can fulfil its objective of migrating our taxplayers online, while dispelling any possible doubts and fears from our taxpayers on the new system.”

Recent Comments